BTC Price Prediction: Will Bitcoin Reach $200K Amid Bullish Accumulation and Technical Strength?

#BTC

- Institutional Demand: MicroStrategy's $50M purchase signals strong long-term conviction

- Technical Indicators: MACD bullish crossover supports upside potential

- Regulatory Landscape: Japan's stricter rules may temporarily limit retail participation

BTC Price Prediction

BTC Technical Analysis: Current Trends and Future Projections

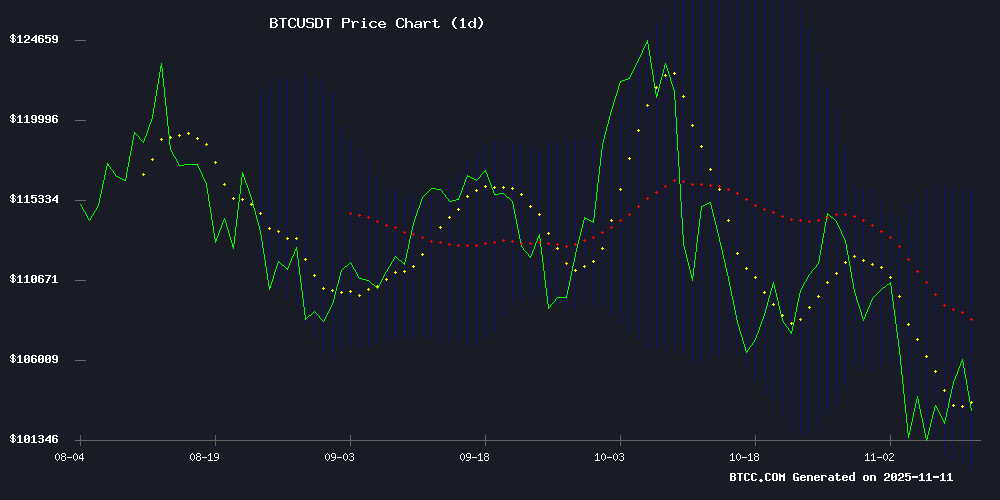

According to BTCC financial analyst Olivia, Bitcoin (BTC) is currently trading at 105,866.38 USDT, slightly below its 20-day moving average (MA) of 107,922.49. The MACD indicator shows a bullish crossover with values at 3997.86 (MACD line), 2522.77 (signal line), and 1475.09 (histogram). Bollinger Bands indicate a potential consolidation phase, with the upper band at 116,013.16, middle band at 107,922.49, and lower band at 99,831.82. Olivia suggests that if BTC holds above the 20-day MA, it could signal a continuation of the bullish trend.

Market Sentiment: Institutional Moves and Regulatory Developments

BTCC financial analyst Olivia highlights mixed market sentiment. On one hand, Japan's tighter crypto custody rules post-DMM bitcoin hack and $1.22B outflows from Bitcoin ETFs reflect short-term caution. However, Michael Saylor's continued BTC accumulation ($50M purchase) and bullish technicals (price holding above $105K) suggest strong institutional confidence. Olivia notes that while profit-taking is occurring, macro factors like the potential end of the Bitcoin treasury bear market could fuel a rally toward $112K resistance.

Factors Influencing BTC’s Price

Japan Tightens Crypto Custody Rules After DMM Bitcoin Hack

Japan's Financial Services Agency (FSA) is moving to impose mandatory registration for cryptocurrency custody providers and trading managers, following the high-profile DMM Bitcoin exchange hack. The regulatory overhaul aims to close security gaps exposed by third-party service providers operating without proper oversight.

The proposed rules would require all digital asset custodians to register with authorities before offering services to exchanges. Existing platforms must now vet their custody partners more rigorously, ensuring compliance with Japan's stringent security standards for customer funds.

This regulatory shift coincides with Japan's broader push to integrate stablecoins into traditional banking systems. The FSA's working group under the Financial System Council has endorsed the measures, signaling accelerated oversight of the country's growing crypto sector.

Bitcoin ETFs See $1.22 Billion Outflow as Institutions Take Profits Amid Market Turbulence

U.S. Bitcoin ETFs bled $1.22 billion last week, marking the third-largest weekly outflow on record. BlackRock's IBIT, Fidelity's FBTC, and Grayscale's GBTC led the withdrawals as macro uncertainty dampened institutional risk appetite. The $558.4 million single-day exit on Friday represented the heaviest outflow since August.

Despite the institutional retreat, Bitcoin defied gravity with a 4.1% surge to $106,155—a testament to resilient retail demand. The divergence highlights shifting dynamics in crypto markets, where Main Street conviction appears to outweigh Wall Street's temporary caution.

Analysts characterize the ETF exodus as profit-taking rather than panic, noting Bitcoin's price stability above six figures. The cryptocurrency continues to demonstrate its uncorrelated nature even as traditional risk assets falter.

Bitcoin Price Prediction 2025: Diverging Views on BTC's Trajectory

James Wynn, a prominent crypto trader, has taken a contrarian stance by shorting Bitcoin with 30% of his stablecoin holdings, predicting a drop to $92,000. His technical analysis cites overbought RSI conditions and anticipates a corrective phase. "The market needs to breathe after this rally," Wynn remarked, though he retains long-term BTC holdings.

Market sentiment remains bullish despite Wynn's bearish bet, with Bitcoin currently trading at $106,362. The divergence highlights crypto's volatility: while technical indicators suggest consolidation, institutional inflows and ETF approvals continue driving momentum. Traders are watching key support levels as the market digests competing narratives.

Bitcoin Treasury Bear Market Shows Signs of Ending as Short Seller Exits MSTR Position

Kynikos Associates' decision to close its short position on MicroStrategy (MSTR) signals a potential turnaround for Bitcoin treasury stocks. The firm, led by short-selling veteran James Chanos, unwound its hedged trade involving MSTR and Bitcoin, citing a significant drop in the company's market Net Asset Value (mNAV).

MicroStrategy's mNAV premium has collapsed from $70 billion to $15 billion since July, with the current ratio standing at 1.23x compared to 2.0x earlier this year. This development coincides with improving market sentiment following the US Senate's deal to avert a government shutdown, which provided upward momentum for Bitcoin's price.

The move by a prominent institutional bear suggests growing confidence in Bitcoin-exposed equities after a prolonged downturn. MicroStrategy shares have halved from their 2025 peak, potentially creating undervaluation opportunities as the company maintains the largest corporate Bitcoin treasury.

Strategy Expands Bitcoin Holdings with $50M Purchase, Solidifying Market Dominance

Strategy has added $50 million worth of Bitcoin to its crypto reserves, acquiring the coins between November 3 and November 9, 2025, at an average price of $102,557 per BTC. The latest purchase brings the company's total holdings to 641,692 BTC—a staggering 3% of Bitcoin's total supply—valued at over $67 billion at current market prices.

Unlike previous acquisitions, Strategy funded this purchase through perpetual preferred stock sales rather than diluting common shares. The company sold four classes of preferred stock—Series A Strife, Stretch, Strike, and Stride—while retaining $15.8 billion in Class A common stock for future investments.

With an average acquisition cost of $74,079 per Bitcoin, Strategy's treasury now represents the largest corporate Bitcoin stockpile globally. The accumulation, which began in August 2020, underscores institutional confidence in Bitcoin's scarcity value as the asset approaches its 21 million supply cap.

Michael Saylor's Strategy Inc. Continues Aggressive Bitcoin Accumulation Amid Market Volatility

Michael Saylor's Strategy Inc., formerly MicroStrategy, has added 487 BTC to its holdings at an average price of $102,557 per coin, bringing its total Bitcoin treasury to 641,692 BTC valued at over $67 billion. The acquisition was financed through preferred shares, circumventing dilution for existing shareholders.

Despite a 26.1% year-to-date gain on its Bitcoin position, Strategy's stock (MSTR) has faced downward pressure as markets question the sustainability of its accumulation strategy. Saylor remains unwavering, framing Bitcoin as a hedge against monetary debasement rather than a speculative asset.

The company's latest purchase follows its established pattern of using alternative financing mechanisms. Preferred share offerings (STRF, STRK, STRC, STRD) allow continued accumulation without traditional equity dilution—a calculated approach that maintains shareholder value while expanding crypto exposure.

Bitcoin Holds Firm Above $105K as Technical and Macro Factors Fuel Rally

Bitcoin maintains bullish momentum above $105,000, with a decisive weekly close above the EMA-50 signaling strength. The cryptocurrency's decoupling from global M2 money supply growth underscores its evolving role as a macro asset.

Trading between critical support at $100,000 and resistance at $115,000, Bitcoin's market structure appears resilient. Institutional demand continues to provide a firm foundation, with ETF inflows supporting price action despite moderate volatility.

Analysts highlight the $115,000 level as the next psychological barrier, with repeated tests of this zone likely before any breakout. The current technical setup suggests accumulation occurring at higher price levels than previous market cycles.

Bitcoin Price Stabilizes Above $104K Amid Bullish Signals

Bitcoin's price action shows resilience after a brief pullback from $106,000, now stabilizing above $104,500. Analysts highlight a bullish trendline on short-term charts, suggesting potential upward momentum. The cryptocurrency closed intraday at $106,033, marking a 4% gain amid optimism tied to U.S. fiscal developments.

On-chain data reveals strong support levels, with long-term holders accumulating at current prices. Market participants await confirmation of a sustained breakout toward the $111,000 recovery zone. Traders are advised to monitor intraday movements closely, as the balance between support and resistance remains delicate.

Chinese Businesswoman Sentenced to 14 Years for Multi-Billion Dollar Bitcoin Ponzi Scheme

Chinese authorities have finally closed a seven-year investigation into Qian, a businesswoman who orchestrated a sprawling Ponzi scheme that defrauded thousands of investors globally. Her operation, which preyed heavily on elderly and inexperienced investors, promised outsized returns but instead funneled new investor funds to pay off earlier participants.

The scheme unraveled when British authorities seized over 61,000 BTC—worth approximately $6 billion at current valuations—tracing the assets through Qian's luxury purchases. This marks one of the largest crypto-related asset seizures in history.

Qian fled China in 2017 using forged documents, attempting to launder stolen funds through UK property and Bitcoin conversions. The cross-border nature of the case underscores growing challenges in crypto-related financial crimes.

Saylor Continues Bitcoin Accumulation as Market Awaits Break Above $112K

MicroStrategy's Michael Saylor has added another 397 BTC to its corporate treasury, reinforcing his unwavering conviction in Bitcoin as a digital reserve asset. The latest purchase comes as institutional investors watch cautiously, with ETF flows mirroring this accumulation strategy at a measured pace.

Bitcoin currently hovers near $105,000 amid a complex macroeconomic landscape. Technical analysts suggest a decisive break above $112,000 could trigger a short squeeze, though market participants remain wary. Funding rates show restraint, futures premiums remain soft, and leveraged traders approach the market with caution following recent liquidations.

Washington politics loom as a potential catalyst. Resolution of the U.S. government shutdown could shift market sentiment dramatically. Notably, short-seller Jim Chanos recently closed his bearish position on MicroStrategy stock—a development that market watchers interpret as a subtle shift in institutional sentiment toward Bitcoin adoption.

Japan's FSA Proposes Stricter Crypto Custody Regulations to Bolster Security

Japan's Financial Services Agency (FSA) is advancing a regulatory overhaul targeting cryptocurrency custody services, with proposed amendments to the Financial Instruments and Exchange Act slated for 2026. The initiative aims to curb what officials describe as "anarchy" in the digital asset custody market by mandating formal registration for service providers.

The framework requires custody operators to register with regulators before offering services to exchanges, creating a firewall against cyber threats. This move aligns with Japan's broader strategy to position itself as a leader in secure crypto adoption, encouraging self-custody while tightening oversight of third-party providers.

Market observers note the proposal could reshape exchange operations in Japan, particularly for platforms handling Bitcoin and other major digital assets. The FSA's approach reflects growing global recognition of custody security as critical infrastructure for institutional crypto adoption.

Will BTC Price Hit 200000?

Olivia from BTCC provides a data-driven outlook:

| Factor | Impact |

|---|---|

| Technical Indicators | MACD bullish, but price below 20-day MA suggests near-term resistance at $107,922 |

| Institutional Activity | Strategic $50M+ purchases by MicroStrategy offset ETF outflows |

| Regulatory News | Japan's stricter rules may temporarily dampen sentiment |

While $200K is possible in 2025 if institutional accumulation continues and BTC breaks $112K, current technicals suggest a more conservative near-term target of $120K-$150K.

- Institutional Demand: MicroStrategy's relentless accumulation ($50M purchase) counters ETF outflows

- Technical Setup: MACD bullish but Bollinger Bands show consolidation needed before next leg up

- Macro Triggers: Potential end of treasury bear market could unlock new capital inflows